Samsung Electronics has officially taken its biggest leap yet into the world of extended reality with the debut of the Galaxy XR Headset — a device that merges the power of artificial intelligence with the depth of immersive computing. Co-developed with Google and Qualcomm Technologies, this headset is being hailed as the first truly AI-native XR device built on the new Android XR platform. More than just a piece of futuristic hardware, the Galaxy XR represents Samsung’s vision of what personal computing could look like in the AI age — a seamless blend of work, creativity, and play.

Design That Feels Human, Not Heavy

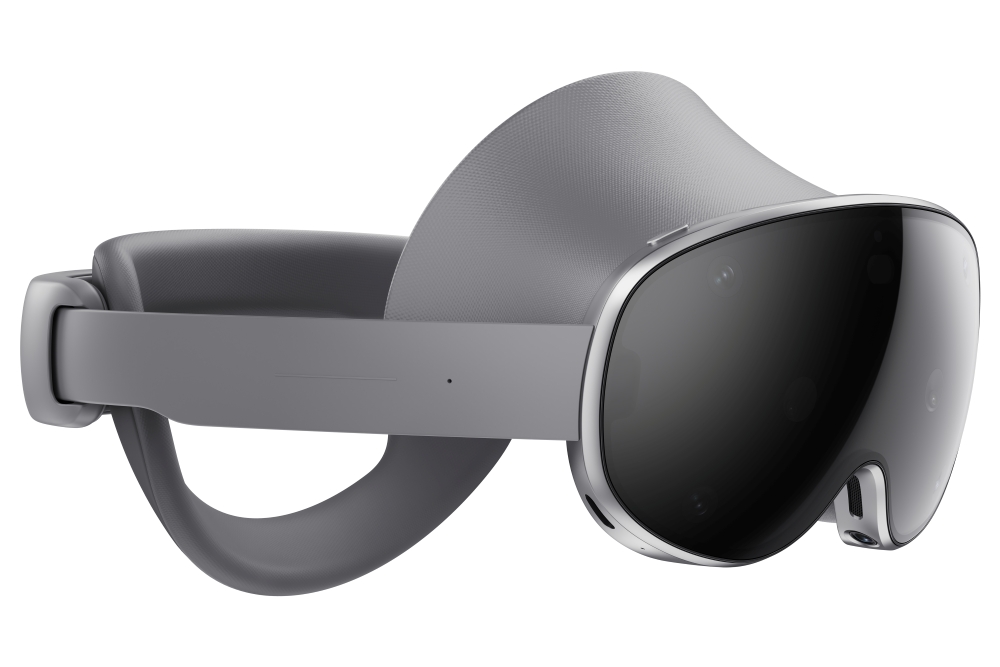

Samsung has clearly learned from the shortcomings of earlier XR devices. The Galaxy XR has been built around comfort and usability, ensuring that extended wear doesn’t feel like a chore. Its ergonomically balanced frame distributes weight evenly between the forehead and back of the head, reducing the pressure points that usually cause fatigue.

Unlike many headsets that carry all their weight up front, Samsung smartly designed a separate battery pack — keeping the main headset lightweight and comfortable. The detachable light shield is another thoughtful detail: you can remove it for casual AR use or attach it to dive fully into virtual worlds without distraction. Everything about the design screams intention — this isn’t a gimmick; it’s a headset built for hours of real use.

Display and Immersion: When the Real and Virtual Blur

At the heart of the Galaxy XR is a 4K Micro-OLED display that makes visuals look breathtakingly sharp and vibrant. Whether you’re bingeing Netflix, gaming in mixed reality, or exploring 3D environments, the headset delivers a near-cinematic experience.

It’s not just about the pixels, though. Samsung’s AI-enhanced sensors and precise tracking system bring realism to every movement. Head, hand, and even eye tracking respond naturally, making the virtual world react as intuitively as the real one. Paired with spatial audio, the Galaxy XR builds an experience that feels immersive, responsive, and alive.

Performance Meets Intelligence

Under the hood, Samsung packed serious power. The headset runs on Qualcomm’s Snapdragon XR2+ Gen 2 chip, paired with a Hexagon NPU to handle advanced AI workloads. But the real magic lies in Gemini AI integration — baked directly into the operating system.

This means you can speak, gesture, or look at something, and the headset understands what you want. The AI doesn’t just execute commands — it interprets context, offers suggestions, and learns from your behavior. Whether you’re sculpting in 3D, gaming, or brainstorming ideas, the Galaxy XR behaves more like a personal assistant than a traditional gadget.

Android XR: The Platform That Changes Everything

The Galaxy XR is the first device to run on Android XR, a new platform co-created by Samsung and Google to power the next generation of spatial computing. The goal? To make XR experiences as open and familiar as Android smartphones.

Apps built for Android will run naturally within this XR environment, and thanks to OpenXR compatibility, developers can easily bring their existing VR and AR apps to the platform. This open, multimodal ecosystem ensures users aren’t locked into one experience — they can move freely between work, entertainment, and creative tools.

A New Way to Explore, Play, and Create

Samsung wants the Galaxy XR to be more than a tech demo — it wants it to become part of daily life. Imagine using AI-guided navigation through Google Maps, watching YouTube videos that respond to your gaze, or identifying real-world objects instantly using the Circle-to-Search gesture.

Even personal memories get a futuristic twist — photos and videos can be spatialized into 3D, letting you step back into your moments. Gamers will love AI-powered assistance that offers real-time coaching and feedback, while creative professionals can tap into Adobe’s Project Pulsar for layered 3D video editing that makes XR filmmaking a reality.

Built for Business Too

Samsung isn’t just targeting consumers. With the Galaxy XR, the company is also eyeing enterprise and industrial applications. In collaboration with Samsung Heavy Industries, the headset is being tested for virtual training and industrial design simulations. Meanwhile, Snapdragon Spaces opens the door for developers to build XR tools tailored to business collaboration, product design, or technical training. It’s clear Samsung sees XR not as a novelty — but as the next big workspace revolution.

Battery and Everyday Usability

Battery life clocks in at around 2.5 hours — decent for an immersive device — and the external battery pack helps maintain comfort during long sessions. Built-in noise-canceling microphones make sure voice commands register clearly, even in busy surroundings. These small but essential usability choices show that Samsung isn’t chasing specs alone; it’s designing a headset people can actually live with.

Verdict: Samsung’s Vision of the Future

The Samsung Galaxy XR Headset isn’t just another gadget — it’s Samsung’s statement about the future of human-computer interaction. With its thoughtful design, cutting-edge AI integration, and seamless ecosystem, it represents the company’s most ambitious attempt to make XR both useful and personal.

While it may initially appeal to enthusiasts, creators, and professionals, the technology it showcases points toward a future where headsets could become as common as laptops or smartphones. Samsung hasn’t just entered the XR race — it’s helped define the track.